Full article with thanks to https://www.starlingbank.com/blog/what-is-ir35-and-how-to-prepare/ If you’re a freelance contractor working for an end client, you should be aware of the IR35 tax regulation, commonly known as the ‘off-payroll working rules’. New rules around IR35 come into effect on 6 April 2021, after a delay due to the coronavirus pandemic. The government has said that the idea behind IR35 is, “to ensure that people working like employees, but through their own limited company, pay broadly the same tax as individuals who are employed directly.” The new rules bring sections of the private sector in line with the public sector. Does IR35 affect me? Before 6 April 2021, a self-employed person who provided services to clients in the private sector via their own limited company, known as a Personal Services Company (PSC), could decide their own tax status and bill them through that limited company. If the end client was in the public …

Finding an accountant

Full article with thanks to https://www.starlingbank.com/resources/business-guides/finding-an-accountant-for-your-business/ If your business is taking off and you find yourself spending too much time figuring out financial admin, it might be a good idea to hire an accountant. A good accountant can be a real asset to you – they can help free up your time. Here we cover the basics of what you should consider before hiring an accountant. One thing before we start – remember that if you’re a Starling business customer, you could also try out our Business Toolkit, with all kinds of bells and whistles for accountancy and VAT. What does an accountant do? An accountant can help you comply with your tax and Companies House obligations by filing the appropriate forms and accounts. A good accountant will be able to offer tax advice so that you’ll have more money to reinvest in your business. The best sort of accountants will …

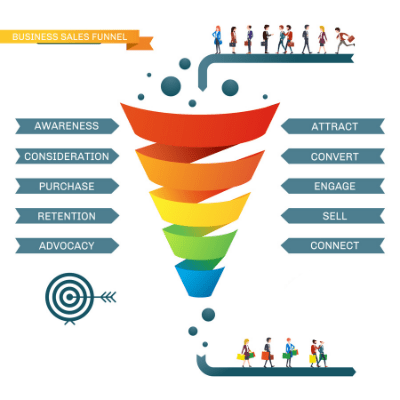

The Beginner’s Guide to a Sales Funnel

Full article with thanks to https://www.mailmunch.com/blog/sales-funnel/ The Beginner’s Guide to a Sales Funnel. Everyone who has an online business needs to create a sales funnel in order to convert their website visitors into paying customers. If you fail to do that, you will hardly make any money. Your primary goal with your sales funnel is to move people from one stage to another until they are ready to purchase. In this blog post, we’ll explain how to create a sales funnel for your online business. What is a Sales Funnel? A sales funnel is a marketing concept that maps out the journey a customer goes through when making any kind of purchase. The model uses a funnel as an analogy because a large number of potential customers may begin at the top-end of the sales process, but only a fraction of these people actually end up making a purchase. As …

Maternity pay for self-employed mums

Full article with thanks to https://www.freeagent.com/guides/small-business/maternity-pay-leave-self-employed-mothers/ Navigating the ins and outs of maternity leave while you’re in full-time employment is one thing, but figuring out maternity leave when you’re self-employed can be even trickier. Fortunately, there are a few different options available for self-employed mothers. From applying for Maternity Allowance to freelancing during your maternity leave, there are a number of different ways you can protect yourself financially during this time. What is Statutory Maternity Pay? Statutory simply means ‘required by law’, and Statutory Maternity Pay is the pay that employers must provide to their eligible contracted employees. Am I eligible for Statutory Maternity Pay if I’m self-employed? Unfortunately not. To be eligible for Statutory Maternity Pay (SMP), you must have a full-time employment contract with a company that pays you through PAYE and deducts National Insurance and tax for you. You’d also have to have worked for that company for at least 26 …

Starting a food business from home

Full article with thanks to https://www.food.gov.uk/business-guidance/starting-a-food-business-from-home Guidance on how to get compliant and protect your customers when starting a food business from home during COVID-19. This guidance is for individuals starting food businesses from home. Read in conjunction with our food hygiene and food safety guidance, following these steps will ensure hygiene standards are met, and your customers are protected. During the coronavirus (COVID-19) pandemic many have turned to the kitchen during lockdown. While a pastime for most, others have looked to turn this into an income. With more people cooking and baking from home, some have started to sell to their local community or online as a source of revenue and a potential career. Equally, some catering and hospitality workers have switched to their own kitchen to operate food delivery businesses from home. As part of our Here to Help campaign we are providing support and guidance to help food businesses further adapt during COVID-19. …

Tax Changes For The Self Employed In 2021/2022

Full article with thanks to https://www.moneydonut.co.uk/blog/21/03/tax-changes-self-employed-2021-22 If sole traders want to prepare for the 2021/22 tax year, they need look no further than Rishi Sunak’s much-talked-about Budget. In it, the chancellor promised to do whatever it takes to protect jobs and livelihoods and outlined how the government intends to support the self employed. To save you the trouble of researching each change, we’ve asked Mike Parkes from GoSimpleTax to list the three big updates and explain how they might affect you. Additional COVID-19 support Both the Coronavirus Job Support Scheme (or furlough scheme) and the Self-Employment Income Support Scheme (SEISS) are set to be extended until September 2021. There will be two remaining SEISS grants, amounting to five grants in total. The fourth will cover February 2021 to April 2021 and, provided you filed your 2019/20 tax return before midnight on the 2nd March (and meet similar criteria to the previous rounds of funding), you’re likely …

How to get a mortgage being self employed

Full article with thanks to https://afiaus.com/how-to-get-a-mortgage-being-self-employed/ How To Get a Mortgage Being Self- Employed Here is a step by step guide on the process to enable you to get the best mortgage for your particular needs. The first step is getting your accounts in order. Most lenders are happy to give mortgages to self-employed people who have been trading for at least three years and have two years of accounts or self-assessment tax returns available. However, if you are unable to get three years accounts you may still be able to get a mortgage. Speak to an accountant Lenders prefer borrowers to employ an accountant to prepare self-employed workers’ accounts. Some lenders state the accountant must be certified or chartered – so bear this in mind when choosing one. Make sure your credit is good Make sure your credit is good and that you are permissible to be lent to. …

How to register as self-employed with HMRC

Full article with thanks to https://www.simplybusiness.co.uk/knowledge/articles/2019/11/how-to-set-up-as-self-employed-with-hmrc-uk/ So you’ve decided to take the leap and set up as self-employed? Congratulations – you’re at the beginning of an exciting journey. Before you really get stuck in, there are a few things you should have covered. The first is setting up as self-employed with HMRC and, most likely, registering as a sole trader. Use our how to register as self-employed guide to tick this task off your to-do list. How to register as self-employed with HMRC – step by step We’ll take you through the process in depth, but here’s a quick overview of how to register as self-employed: Check your work counts as self-employment using the Employment Status Indicator Register for an online account with gov.uk Wait for your details, which will arrive by post Complete your registration using your Government Gateway details, as well as information about your business, like trading name and contact …

Understanding Bounce Rate in Google Analytics

Full article with thanks to https://yoast.com/understanding-bounce-rate-google-analytics/ What is a bounce rate and why is it important? Do your research. Build your website. Launch your business. Pay for advertising….and…..nothing happens. There are lots and lots of reasons why this might have happened – and without taking a look at your business model, website and advertising I can’t immediately tell you what the issue is (happy to offer you a free consultation so I can try to do just that though – book on my website). But your website stats – and your bounce rate will certainly give you a clue. The questions you need to ask are: 1) Is my advertising working? (if your advertising has resulted in more people going to your website then potentially yes – if no then you need to relook at your advertising and who you’re targeting). 2) How long are people staying on your …

SEO Guide

Full article with thanks to https://www.practicalecommerce.com/seo-how-to-part-1-why-use-it Search engine optimization is the practice of configuring your site to increase organic traffic and conversions driven by Google, Bing, and others. Part science and part art, SEO includes elements from site development, user experience, content creation, and community relations, as well as an understanding of search engines and their algorithms. This post begins a weekly primer in SEO, with the goal of addressing all foundational aspects. In the end, you’ll be able to practice SEO more confidently and converse with others regarding important SEO challenges and opportunities. There are three core aspects of SEO: Indexing: Search engines’ ability to crawl and index your web pages. Relevance: The relevance of your content. Amplifying: Through links, strengthen your content’s relevance and authority signals. Optimizing the relevance and authority signals your site sends to search engines can increase your rankings, which drives visitors to your site. The more relevant …